S&P 500 vs. E-mini S&P 500: Key Differences Explained

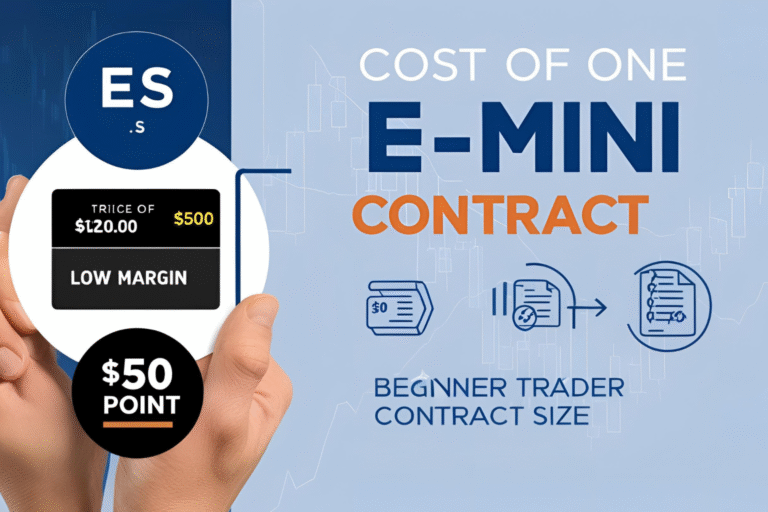

Many new traders confuse the S&P 500 index with the E-mini S&P 500 futures (ES). While they are closely related, they serve different purposes in the market. This guide breaks down the differences between the two, helping you understand how the index tracks the market—and how futures allow you to trade it. What Is the…