E-mini Nasdaq 100 Futures: Weekly Market Outlook

The E-mini Nasdaq 100 (NQ) futures contract is a fast-moving, tech-heavy instrument that tracks the performance of the Nasdaq 100 index. It’s a favorite among active traders due to its volatility and responsiveness to economic data and earnings. This weekly outlook provides a snapshot of NQ futures trends, technical levels, and upcoming catalysts that could shape the market.

Overview of Last Week’s Performance

Last week, E-mini Nasdaq 100 futures showed [insert direction: strength/weakness], driven by:

- Earnings reports from major tech firms (e.g., Apple, Amazon)

- Reactions to U.S. economic data (e.g., CPI, jobless claims)

- Bond yield volatility and Fed commentary

Example: NQ futures gained 2.3% on the week, closing near 18,250 after bouncing from 17,800 support.

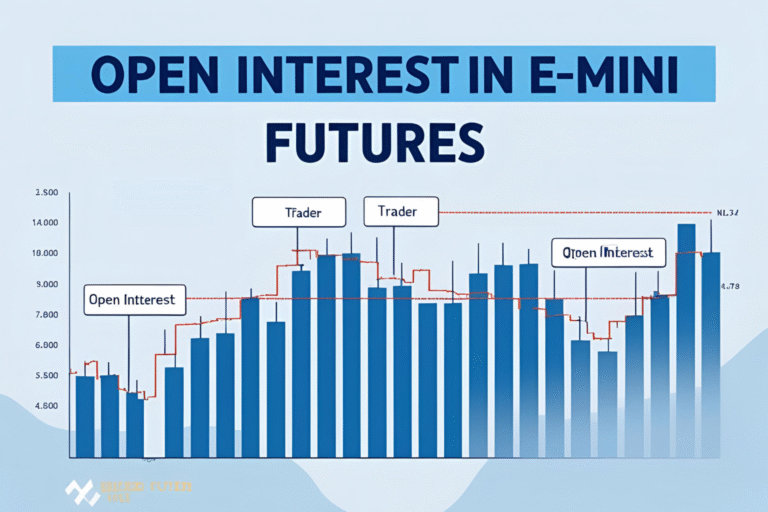

Key Technical Levels to Watch

| Level Type | Price Level (Example) |

|---|---|

| Major Resistance | 18,450 |

| Intermediate Support | 18,100 |

| Strong Support | 17,800 |

| Weekly Pivot Point | 18,200 |

- Trend: NQ remains in a bullish channel on the 4-hour chart, with higher lows forming above the 50 EMA.

- Momentum: RSI is near 60, suggesting moderate bullish momentum; MACD shows a potential crossover.

Upcoming Catalysts This Week

Watch these scheduled events that could impact NQ futures:

- Tech Earnings: Microsoft, Alphabet (if reporting this week)

- Economic Data:

- Retail Sales

- Producer Price Index (PPI)

- Initial Jobless Claims

- Fed Speakers: Any commentary on inflation or rate cuts

- Geopolitical Updates: Ongoing news from global markets or policy shifts

These factors often trigger intraday spikes or set the tone for the entire week.

Trading Plan & Strategy Ideas

- Bullish Bias: Above 18,200, with potential breakout to 18,500+

- Bearish Scenario: Failure at 18,200 with a breakdown toward 17,800 support

- Range Play: Between 17,900–18,400 for neutral momentum strategies

Tip: Use VWAP and volume profile to validate breakout attempts and confirm trend continuation.

FAQs

What is the tick size and value for NQ futures?

The tick size is 0.25, and each tick is worth $5 per contract.

How volatile is the E-mini Nasdaq compared to ES?

NQ is typically more volatile than ES, making it more suitable for experienced traders or those using tight risk management.

When is the best time to trade NQ futures?

The best times are during the U.S. session (9:30 a.m. to 11:30 a.m. ET) and around economic news releases.

Can I use the same strategies for ES and NQ?

Yes, but adjust for volatility. NQ often requires wider stops and faster trade execution.

Is swing trading possible with NQ futures?

Yes. Many traders use weekly outlooks and macro analysis to hold positions for 2–5 days based on trend direction.