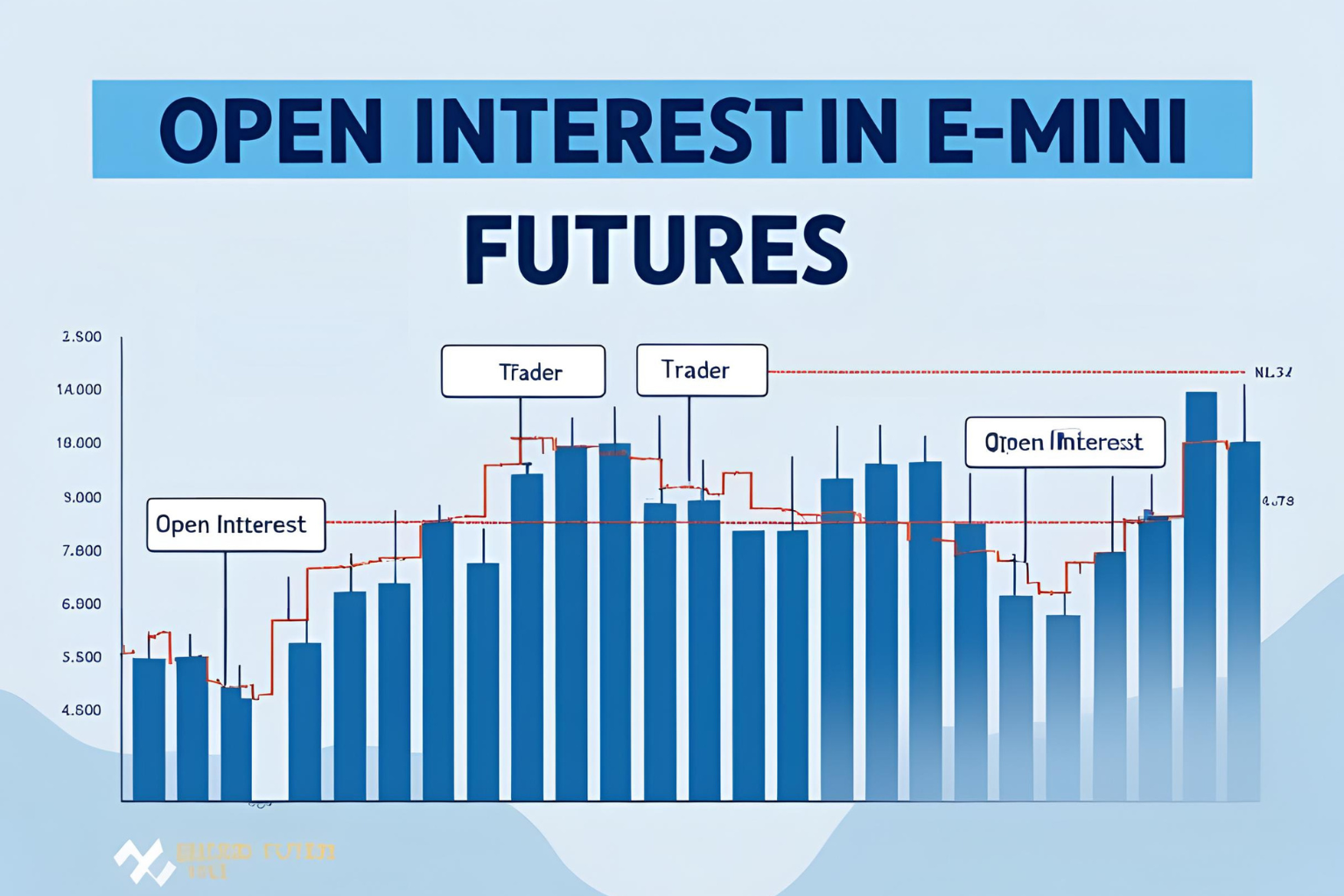

Open Interest in E-mini Futures: What It Tells Traders

Open interest is a powerful yet often overlooked metric in E-mini futures trading. It provides clues about market participation, trend conviction, and potential reversals. Whether you’re trading the E-mini S&P 500 (ES) or Nasdaq 100 (NQ), understanding open interest can sharpen your analysis and improve your trade timing.

What Is Open Interest?

Open interest (OI) refers to the total number of outstanding futures contracts that are active but not yet settled. Every time a new long and short position is created, open interest increases by one. When a trade is closed (one party exits the position), open interest decreases.

Unlike volume, which resets daily, open interest reflects the current level of engagement in the market.

Why Open Interest Matters in E-mini Trading

1. Confirms Strength of Price Moves

- Rising price + rising open interest = strong bullish trend.

- Falling price + rising open interest = strong bearish trend.

- If price rises but OI falls, the move may lack conviction and could reverse.

2. Detects Reversals

When open interest reaches unusually high levels near key support or resistance, it could signal position exhaustion—a potential reversal point.

Example: If ES futures rally into 5300 resistance with OI peaking, it could suggest longs are trapped and due to unwind.

3. Measures Liquidity and Trader Activity

High OI typically leads to tighter spreads and smoother fills—important for scalpers and day traders. ES and NQ generally have high open interest, especially in the front-month contracts.

4. Tracks Participation in Rollover Periods

As expiry approaches, OI shifts from the front month to the next contract. Tracking this helps you avoid trading low-liquidity contracts or slippage.

How to Use Open Interest with Other Indicators

- Combine with volume to confirm participation behind a breakout or breakdown.

- Use with price action to detect fakeouts (e.g., price breakout on low volume and OI may not sustain).

- Monitor along with sentiment tools (like VIX or DXY) for broader confirmation.

Where to Find Open Interest Data

- CME Group: Official daily OI data by contract.

- Broker Platforms: Most platforms like NinjaTrader, Thinkorswim, or TradingView show OI per instrument.

- TradingView: Use the “OI” indicator if supported by your data plan.

FAQs

Is open interest the same as volume?

No. Volume is the number of contracts traded in a day. Open interest is the number of open positions still held.

Does high open interest mean bullish sentiment?

Not always. High OI shows activity, but you need price direction to understand sentiment.

Can open interest predict market direction?

Not directly, but changes in OI combined with price and volume can help identify trend strength or reversals.

Why does open interest drop before contract expiry?

Traders roll their positions into the next contract, causing the current month’s OI to decline.

Is open interest useful for intraday trading?

Yes—especially during high-impact days or near support/resistance zones. It helps confirm strength or fading momentum.