Is ES the Same as S&P 500? Clearing the Confusion

If you’re new to futures trading, you’ve probably come across the term “ES” and wondered whether it’s the same as the S&P 500. The short answer: they are closely related, but not the same.

In this post, we’ll break down the difference between ES futures and the S&P 500 index, so you can better understand what you’re trading—and how they’re connected.

What Is the S&P 500?

The S&P 500 is a stock market index that tracks the performance of 500 large-cap U.S. companies. It’s widely considered the benchmark for the U.S. stock market.

- Ticker Symbol: SPX

- Managed by: S&P Dow Jones Indices

- Use case: Benchmark for funds, economic outlook, and investor performance

You can’t directly trade the index itself, but you can trade products that track or mirror its movement.

What Is ES?

ES is the ticker symbol for the E-mini S&P 500 futures contract, which is a derivative product based on the S&P 500 index.

- Ticker Symbol: ES

- Exchange: Chicago Mercantile Exchange (CME)

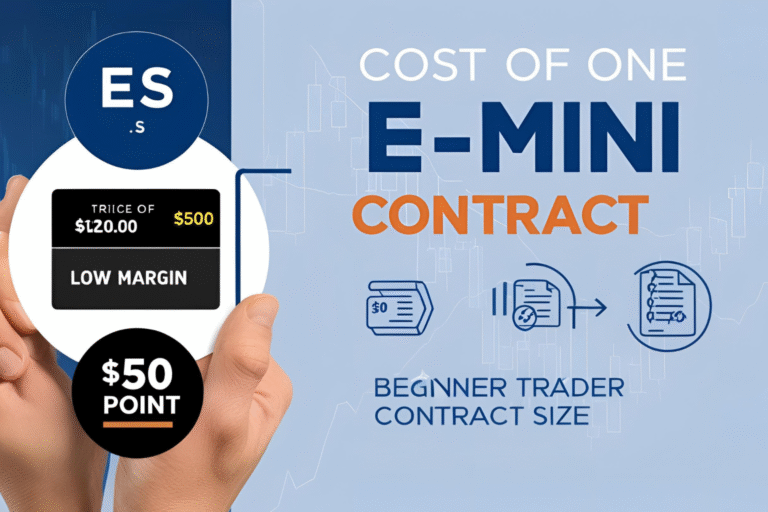

- Contract Size: $50 × S&P 500 Index Level

- Tradable?: Yes—it’s one of the most actively traded futures contracts in the world

So while ES is not the same as the S&P 500, it is designed to track it very closely.

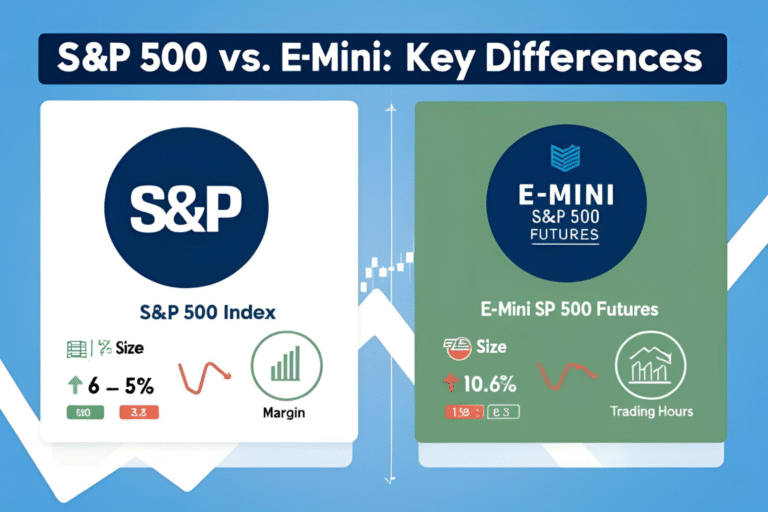

ES vs S&P 500: Key Differences

| Feature | S&P 500 Index (SPX) | E-mini Futures (ES) |

|---|---|---|

| Type | Market index | Futures contract (derivative) |

| Tradable Directly? | No | Yes |

| Leverage | None | High |

| Trading Hours | Market hours only | Nearly 24/5 |

| Price Movement | Reflects real-time market | Tracks index closely |

| Expiration | N/A | Quarterly (Mar, Jun, Sep, Dec) |

Why ES Tracks the S&P 500

The value of the ES contract is derived directly from the S&P 500 index. Each ES point is worth $50, and its price closely follows the index during trading hours. When the S&P 500 moves, ES usually moves in near-perfect sync—though slight differences can occur due to:

- After-hours trading

- Market sentiment and expectations

- Futures premiums or discounts

When to Use ES Instead of SPX

- If you want to actively trade intraday

- If you want exposure to the S&P 500 with leverage

- If you need nearly 24-hour access to markets

- If you’re looking to hedge other positions

FAQs

Does ES always match the S&P 500 price exactly?

Not always. Minor differences may occur due to overnight trading or futures pricing mechanics.

Can I use ES to predict S&P 500 movement?

Yes. ES often leads the market during pre-market and after-hours sessions.

Is ES better for short-term or long-term trading?

ES is more suitable for short- to medium-term trading due to leverage and expiration cycles.

Does ES pay dividends like SPX?

No. ES is a derivative and does not pay dividends. Dividends are priced into the futures contract.

Can I hold ES contracts overnight?

Yes, but make sure you meet the overnight margin requirements, which are much higher than day trading margins.