S&P 500 vs. E-mini S&P 500: Key Differences Explained

Many new traders confuse the S&P 500 index with the E-mini S&P 500 futures (ES). While they are closely related, they serve different purposes in the market. This guide breaks down the differences between the two, helping you understand how the index tracks the market—and how futures allow you to trade it.

What Is the S&P 500 Index?

The S&P 500 is a market-cap-weighted stock index that tracks the performance of 500 of the largest publicly traded companies in the U.S. It’s a benchmark used by investors to gauge the overall health of the stock market.

- Symbol: SPX (cash index)

- Provider: Standard & Poor’s (a division of S&P Global)

- Purpose: Benchmark index for investing and comparison

You can’t directly trade the S&P 500 index itself. Instead, you trade products that track it, such as ETFs or futures.

What Is the E-mini S&P 500 Futures Contract?

The E-mini S&P 500 (ES) is a futures contract that derives its value from the S&P 500 index. It allows traders to speculate on the future price of the index or hedge other positions.

- Symbol: ES

- Exchange: Chicago Mercantile Exchange (CME)

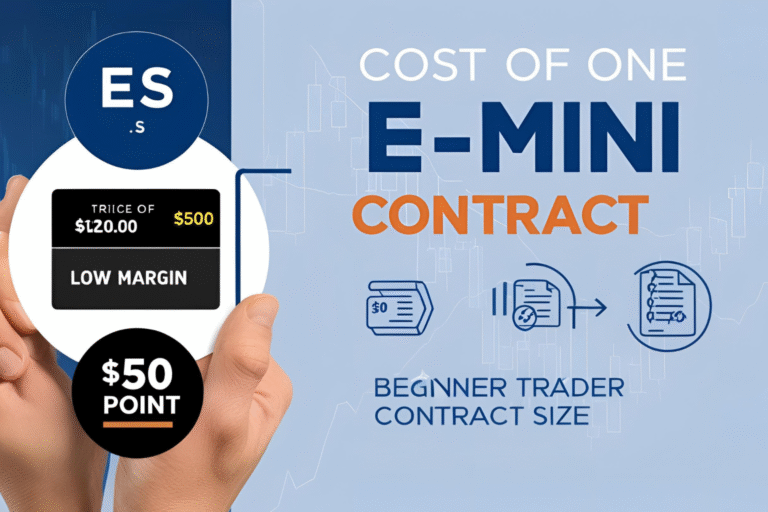

- Contract Size: $50 × S&P 500 Index

- Leverage: High—can control large positions with small capital

- Trading Hours: Nearly 24/5 (Sunday 6 p.m. to Friday 5 p.m. ET)

ES futures are cash-settled, not involving delivery of stocks.

Key Differences: S&P 500 vs. E-mini S&P 500

| Feature | S&P 500 Index | E-mini S&P 500 Futures |

|---|---|---|

| What It Is | Stock market index | Futures contract |

| Symbol | SPX | ES |

| Tradable? | No | Yes |

| Purpose | Benchmark, reference | Speculation, hedging |

| Contract Size | N/A | $50 × index value |

| Leverage | None | Yes |

| Trading Hours | Market hours (9:30–4 ET) | Nearly 24 hours (Sun–Fri) |

| Margin Required | N/A | ~$500–$12,000 (varies) |

Who Uses Each?

S&P 500 Index

- Long-term investors

- Fund managers comparing portfolio performance

- Passive investors via ETFs like SPY

E-mini S&P 500 Futures (ES)

- Active day traders and swing traders

- Institutions hedging equity portfolios

- Speculators capitalizing on leverage and volatility

Why Traders Choose E-mini Futures

- Liquidity: ES is among the most liquid futures contracts in the world.

- Leverage: Control a large notional amount with relatively small capital.

- Extended Trading: Trade outside stock market hours.

- No Pattern Day Trader Rule: Unlike stocks, you can day trade with smaller accounts.

FAQs

Is the E-mini S&P 500 the same as the S&P 500 index?

No. The E-mini futures contract tracks the index, but it is a separate financial instrument used for trading.

Why trade ES instead of SPY ETF?

ES offers more leverage, better tax treatment for some traders, and trades nearly 24 hours a day.

Can I invest in the E-mini S&P 500 long-term?

It’s possible, but ES is better suited for short- to medium-term trades due to expiration and margin requirements.

What is the tick size for ES futures?

Each tick is 0.25 index points, and each tick is worth $12.50 per contract.

Do ES futures expire?

Yes. Contracts expire quarterly (March, June, September, December), but most traders roll over positions before expiration.