What is E-mini Trading? A Beginner’s Guide

E-mini trading refers to buying and selling E-mini futures contracts, which are smaller-sized versions of standard futures contracts traded on the Chicago Mercantile Exchange (CME). They offer a cost-effective way to speculate on market indices like the S&P 500 and Nasdaq 100 with lower capital requirements. E-mini futures are among the most popular instruments for retail and professional traders alike.

In this guide, you’ll learn what E-mini trading is, how it works, and how to get started.

What Are E-mini Futures?

E-mini (short for “Electronic Mini”) futures are:

- Electronically traded

- Cash-settled

- Fractional-sized versions of full-sized futures contracts

They track major market indices such as:

- E-mini S&P 500 (ES)

- E-mini Nasdaq 100 (NQ)

- E-mini Dow Jones (YM)

- E-mini Russell 2000 (RTY)

Key Features of E-mini Contracts

| Feature | E-mini S&P 500 (ES) Example |

|---|---|

| Exchange | CME |

| Ticker Symbol | ES |

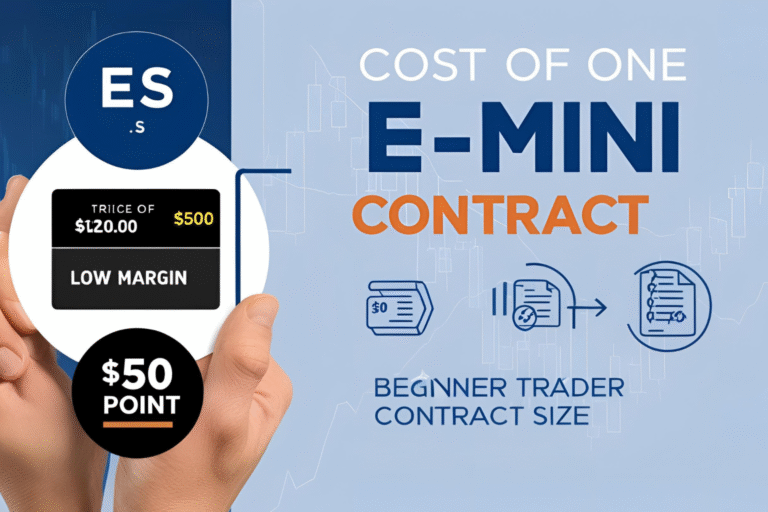

| Contract Size | $50 × S&P 500 Index |

| Tick Size | 0.25 points |

| Tick Value | $12.50 per tick |

| Trading Hours | 6:00 p.m. to 5:00 p.m. ET (Sun–Fri) |

| Expiration | Quarterly (March, June, Sept, Dec) |

| Margin Requirement | As low as $500 intraday (broker-specific) |

Why Trade E-mini Futures?

- Leverage

You can control large market positions with a relatively small amount of capital. - Liquidity

ES and NQ contracts are extremely liquid, meaning tight bid-ask spreads and fast order execution. - Volatility

The intraday price movement provides opportunities for scalping and day trading. - Extended Hours

Unlike stocks, E-mini futures trade almost 24 hours a day, offering more flexibility. - No PDT Rule

E-mini traders are not subject to the Pattern Day Trader rule found in stock trading.

How to Get Started with E-mini Trading

Step 1: Open a Futures Trading Account

Choose a broker like NinjaTrader, TradeStation, or Interactive Brokers that supports futures trading.

Step 2: Understand the Platform and Contract Specs

Get familiar with margin requirements, tick values, trading hours, and how to use your charting software.

Step 3: Start with a Demo Account

Practice placing trades, managing risk, and analyzing charts using a simulated account.

Step 4: Learn Basic Trading Strategies

Start with beginner-friendly setups such as:

- Breakout trading near key levels

- VWAP bounce or mean reversion

- Trend-following using moving averages

Risks to Keep in Mind

- Leverage can amplify losses as well as profits

- Market moves quickly, especially during economic news

- Overtrading can quickly erode your account

Always use stop-loss orders and risk no more than 1–2% of your capital per trade.

FAQs

What’s the difference between E-mini and Micro E-mini?

Micro E-mini contracts are 1/10 the size of E-minis. They’re great for beginners with smaller capital.

Can I trade E-mini futures with $1,000?

Some brokers offer intraday margin as low as $500, but $3,000–$5,000 is more realistic for proper risk management.

Is E-mini trading better than stock trading?

It depends on your goals. E-mini trading offers leverage and extended hours, but also comes with higher risk.

Do E-mini futures pay dividends?

No. Futures are cash-settled and do not involve ownership of underlying assets.

Are E-mini futures taxable?

Yes, but they may qualify for favorable 60/40 tax treatment under Section 1256 in the U.S.